Restaurante de servicio completo | Restaurante de servicio limitado

¿Qué tan rápido aumentan los precios de los restaurantes en 2022?

11/29/2022

Incluso los comensales poco frecuentes han notado un aumento en los precios de los restaurantes en 2022. La inflación récord impulsó el costo de casi todo en el foodservice, desde las proteínas hasta los artículos de papel. Junto con la presión al alza sobre los salarios, los operadores de restaurantes no han tenido muchas opciones más que transferir estos costos a los clientes en los aumentos de precios del menú.

Pero, ¿qué tan rápido aumentan los precios en los restaurantes? ¿Y cómo se compara tu operación?

Aumentos en los precios del menú: restaurantes de servicio limitado vs. restaurantes de servicio completo

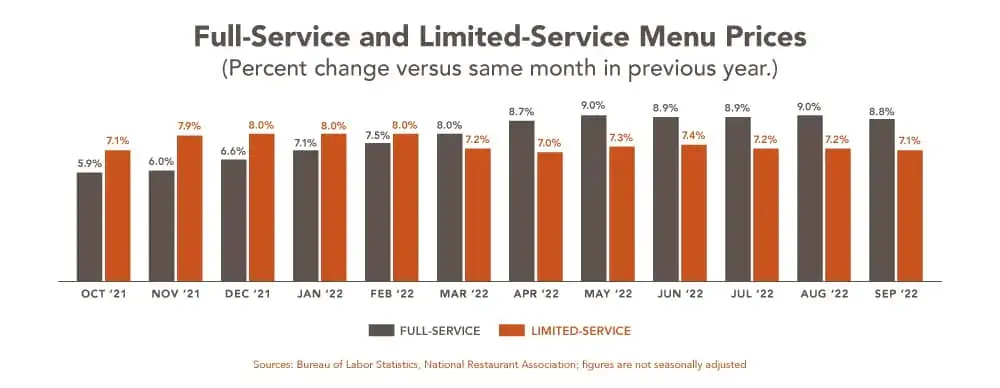

Para fines de 2021, los precios de los menús ya estaban subiendo, con los restaurantes de servicio rápido (restaurantes de servicio rápido, QSR) que lideraban el camino con un aumento del 7.1 % interanual. Este crecimiento alcanzó su máximo a principios de 2022 en un 8 %, y para septiembre se había desacelerado a un aumento del 7.1 % interanual.1

La inflación en los precios de los menús de los restaurantes de servicio completo tomó una trayectoria diferente: aumentó más lento que los precios de los QSR en el otoño de 2021, pero los superó en la primavera siguiente, con un pico del 9.0 % en mayo. Para septiembre de 2022, aún estaban un 8.8 % por encima del año anterior.1

¿Los precios al alza de los restaurantes comienzan a moderarse?

En una palabra, sí. La inflación interanual de los precios del menú para los QSR se ha mantenido estable en alrededor del 9 % desde mayo, y la tasa de crecimiento de precios para los restaurantes de servicio completo ha estado disminuyendo desde junio.1 Entonces, si bien los precios de los restaurantes siguen subiendo, la tasa de aumento se está desacelerando.

Además, un informe de la Oficina de Estadísticas Laborales que se publicó en noviembre reveló que la inflación general había caído al 7.7 % interanual, la más baja desde enero de 2022.2 Si bien es demasiado pronto para saber si este es el comienzo de una tendencia, sigue siendo una señal alentadora.

Los restaurantes tienen poca concurrencia, pero los promedios de las cuentas son altos

Mientras tanto, el flujo de cliente en las principales cadenas de restaurantes ha tenido una tendencia a la baja desde la primavera en todos los segmentos, en especial en los restaurantes informales. Aquí hay un resumen de las disminuciones (interanual) en el tercer trimestre.

Concurrencia en las cadenas principales en el tercer trimestre de 2022 vs. tercer trimestre de 20213

QSR tradicionales: -0.6 %

De nivel medio: -1.9 %

De comida rápida informales: -3.2 %

Informales: -8.1 %

Sin embargo, debido a los precios más altos en los menús, el tamaño promedio de las cuentas ha subido en general.

Promedio de las cuentas de las cadenas principales en el tercer trimestre vs. tercer trimestre de 20213

QSR tradicionales: +5.1 %

De nivel medio: +6.2 %

De comida rápida informales: +5.0 %

Informales: +6.6 %

Cómo responden los clientes de las cadenas de restaurantes al aumento de los precios del menú

En general, el 86 % de los clientes de restaurantes dicen que han notado el aumento en los precios del menú, incluido el 64 % de los clientes de QSR.4, 5

Dado que salir a comer representa un mayor gasto en los presupuestos familiares, los clientes están elevando sus expectativas del servicio. Según Datassential, el 55 % de los operadores dice que el tiempo que se necesita para completar un pedido no ha cambiado; el 44 % de los operadores de restaurantes de comida rápida informales afirman que el servicio es más rápido que los seis meses anteriores.6

Aun así, el 27 % de los clientes de los QSR ha informado que se tarda más en pedir comida, y el 20 % dice que los restaurantes tardan más en prepararla.6 Ya sea la percepción o la realidad, los restaurantes deberían asegurarse de que su calidad de servicio se mantenga al ritmo de los precios. Los consumidores estadounidenses ya se ven afectados por la inflación en la economía en general, y cualquier decepción en la experiencia gastronómica podría alentarlos a comer en casa.

1Bureau of Labor Statistics (Oficina de Estadísticas Laborales), National Restaurant Association, noviembre de 2022

3NPD CREST®, 3 meses hasta septiembre de 2022

4 Technomic, Inc., State of the Industry (Estado de la industria), junio de 2022

5Datassential LSR report, agosto de 2022

6Datassential, Speed of Service report (Informe sobre la velocidad del servicio), agosto de 2022

- Beneficios de lo congelado

- Colegio y universidad

- Delicatesen

- Desde la cocina de prueba

- Entrega

- Festividades

- Historias de cocina

- K-12

- Mano de obra y personal

- Mercadeo

- Minorista

- Noticias

- Papas a la francesa

- Planificación de menú

- Productos nuevos

- Recursos sobre la Covid-19

- Restaurante de servicio completo

- Restaurante de servicio limitado

- Sostenibilidad

- Tendencias alimentarias

- Trend Feast

- Vegetales

- Healthcare