Menu Planning

Should You Raise Your Prices?

8/11/2022

From paper goods to food, record inflation is making life tough for restaurants, and most have already taken steps to fight back. Many have raised menu prices to try to maintain their margins.

But restaurant patrons are fighting their own battle with inflation. So is raising menu prices a good idea? Is there a point where consumers will balk? And have we reached it already?

Restaurant menu price increases are not keeping pace with rising costs

Overall, restaurants are paying 26% more for food and paper costs than they did two years ago. Several essential items are rising much faster than others:

Change in Food Costs vs. Two Years Ago2

Cooking oil +77.8%

Turkey +65.8%

Chicken +62.2%

Fish +49.6%

Dairy +28.2%

All foods +25.5%

On top of that, the hourly wages of restaurant workers have reached or exceeded the pay for skilled positions like entry-level welders and certified nursing assistants ($15 to $18/hour), some of which require licensing.2

Restaurants have responded most commonly by raising menu prices. But for the average operator, these increases are not enough to offset rising labor and food costs.

Technomic calculates that the hikes in labor and food costs have cut gross profitability by 2% despite increases in menu prices. And this estimate did not include the effect of any increases in rent, linens, repairs, or utilities that would hammer profits even more.

Wary of raising prices too high and alienating patrons, restaurants are also employing alternative strategies to maintain margins. After price increases, here are the top four steps restaurants are taking to mitigate higher food and labor costs:

- Emphasizing reducing food waste and spoilage with employees

TIP: Experts estimate restaurants waste 4-10% of all the food they purchase before it even reaches the table.4 Attacking food waste makes even more sense with food prices soaring. Innovative products like Simplot Ready-to-Eat Vegetables and Fruit offer up to six days of refrigerated shelf life can help you cut waste and their thaw-and-serve prep reduces labor. Learn more strategies to curb food waste.

- Revising menu to emphasize items with lower food cost

TIP: Compared to proteins, vegetables are inexpensive, and consumers have shown they’re looking for more plant-based options. Menu items like cauliflower buffalo wings have proven their appeal. Serving on-trend, frozen vegetables like Simplot RoastWorks® Flame-Roasted Vegetables can help you add perceived value to the plate and keep food costs low.

- Adding higher margin items to the menu

TIP: Fries are the most profitable food item on menus. So how can you leverage their popularity and relatively low cost? Loaded fries. They’re popular, high-margin items that you can build using the trim from your other recipes, sauces and seasoning that you already have in your pantry. Check out some loaded fry recipes.

- Increasing focus on product yield

TIP: For many operators, this means reducing portion sizes (“shrink-flation”), but it doesn’t have to. Sometimes it means choosing products with higher yield. All Simplot products offer 100% edible yield. Compare that to fresh corn with only 36% yield after trimming and prep. Plus, we do all the washing, pitting, peeling, and seeding, freeing up your staff for more important work. Learn more about Simplot Simple Goodness™ Premium Vegetables.

Adding mandatory fees to checks is also becoming more common. These “wellness fees,” “equity fees” and “hospitality fees” help operators keep menu prices in check while maintaining profitability.

So far, restaurants have refused to cut back on menu innovation. Only 15% are cutting back on new product development—and that’s a good thing.3 For instance, well executed, limited-time offers (LTOs) continue to prove their value as traffic drivers during downturns. Learn how to make your LTO more successful.

Consumers are reacting differently to the rising cost of dining out

Eighty-six percent of consumers say they have noticed higher menu prices, and, squeezed by record inflation, they’re changing their dining habits.1

However, according to Technomic, their changes are different compared to past recessionary cycles.

Typically consumers have traded down to less expensive options and cut out extras like dessert. Today, they’re visiting restaurants less but maintaining their spending despite higher prices.

- While 45% are cooking at home more often and 29% are using restaurants less…

- …only 14% are ordering fewer or less expensive items, and only 12% are trading down to less expensive restaurants.1

- The average number of items ordered in both limited-serve and full-service restaurants is unchanged from Q4 2021 and is 8%-10% higher than Q1 2020.3

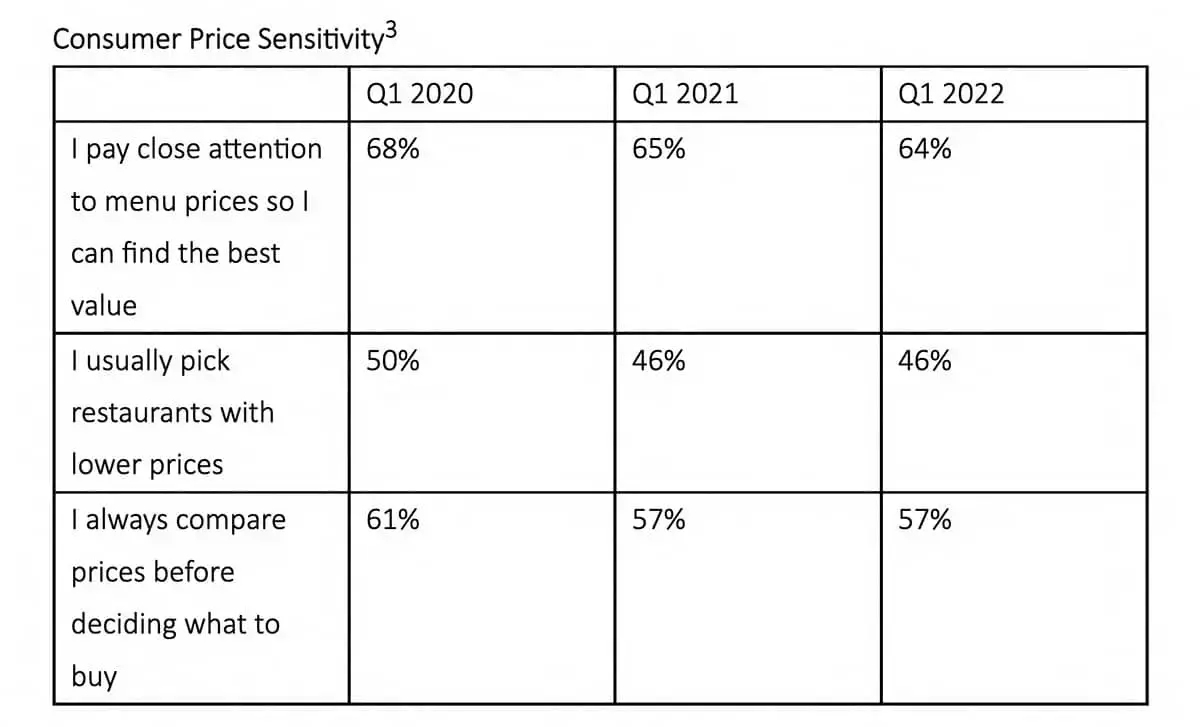

Why? Consumers report being less price sensitive than they were two years ago, perhaps because their wages have also risen.

Menu price is only one factor in patrons’ value equation

Technomic found that consumers viewed $10 as the price point where patrons feel fast food meals start “getting expensive.” The average meal cost as of June 2022 was $10.08, so the room for raising menu prices in that segment may already be limited.1

But remember, consumer perception of value is more than price; consumers always weigh cost against what they get for the money. As a result, many experts believe the best course of action is to focus on creating a dining experience that justifies higher prices, primarily through exciting, new menu items. Many of these new items will take the form of limited-time offers. In a recent study of limited-time offers by Datassential:

- 74% of customers reported paying about the same amount for the LTO as other items on the menu

- 17% percent paid premium pricing

- 55% of consumers have purchased a restaurant LTO in the last two weeks

- 7 in 10 patrons have eaten an LTO in the past month

- 85% of people who enjoy an LTO will return, and 75% will tell someone about it

- 61% of operators regard LTOs as a profit center for their businesses

- Operators report an increase of up to 25% in revenue and traffic during months with a successful LTO5

One bright spot for foodservice is that food costs for grocery stores have risen even faster than their own, helping close the gap between eating out and cooking at home. Your customers may not be visiting as often, but they still want the full experience of great service and flavors they can’t replicate at home—and they’re still willing to pay for the privilege.

1 Technomic, Inc., State of the Industry, June 2022

2 USA Today

3 Technomic, Inc., The Future of Full-Service Restaurants, June 2022

4 NRDC Report

5 Datassential, 2022